- 14. April 2025

History

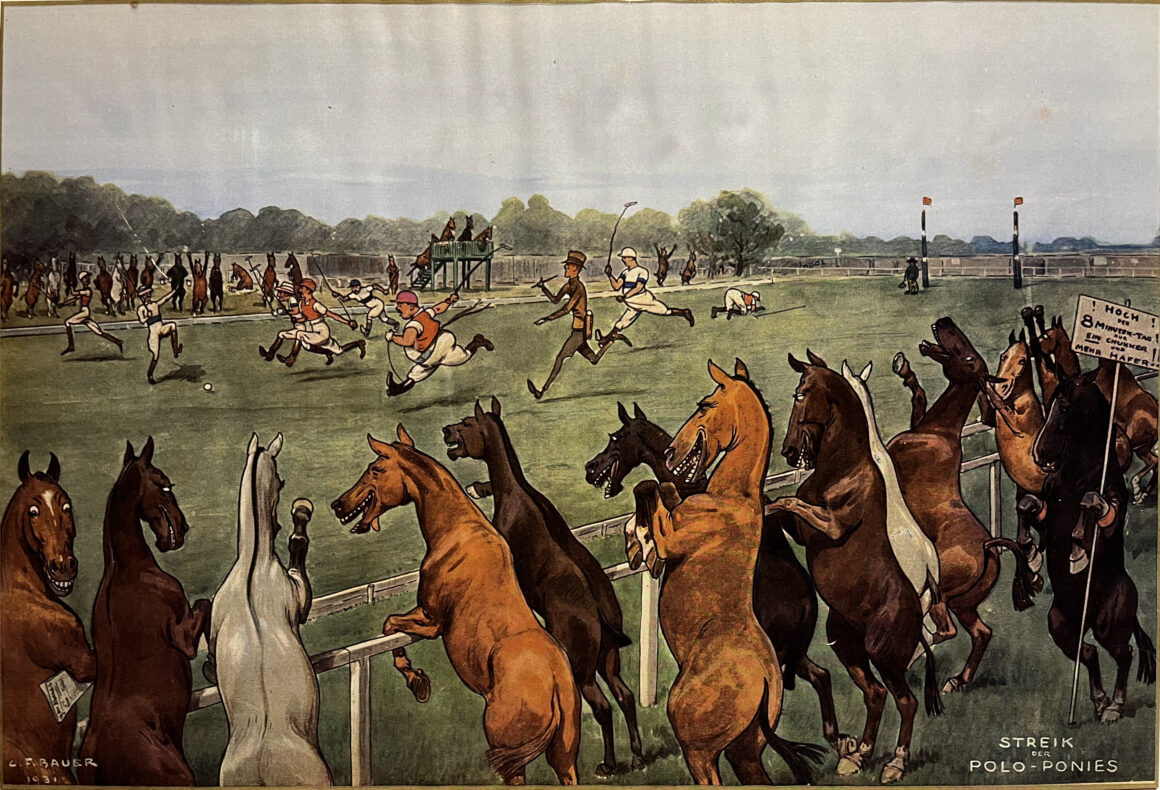

- 20. August 2019

All articles loaded

No more articles to load

CURRENT ISSUE

CURRENT ISSUE

POLO+10 PLAYERS LIST

For players only: The biggest players data base in the world. Subscribe now and receive invitations to polo tournaments all over the world.

- Registration POLO+10 players data base

+10 WORLD: POLO CLUBS & TOURNAMENTS

POLO+10 REAL ESTATE

- 6 June 2024

- 10 November 2023

POLO+10 PUBLISHES YOUR TOURNAMENT MAGAZINE!

Would you like to have your own magazine for your tournament?

Feel free to contact us!

POLO+10 produces your tournament magazine.

Please write to

hello[at]twa.ag