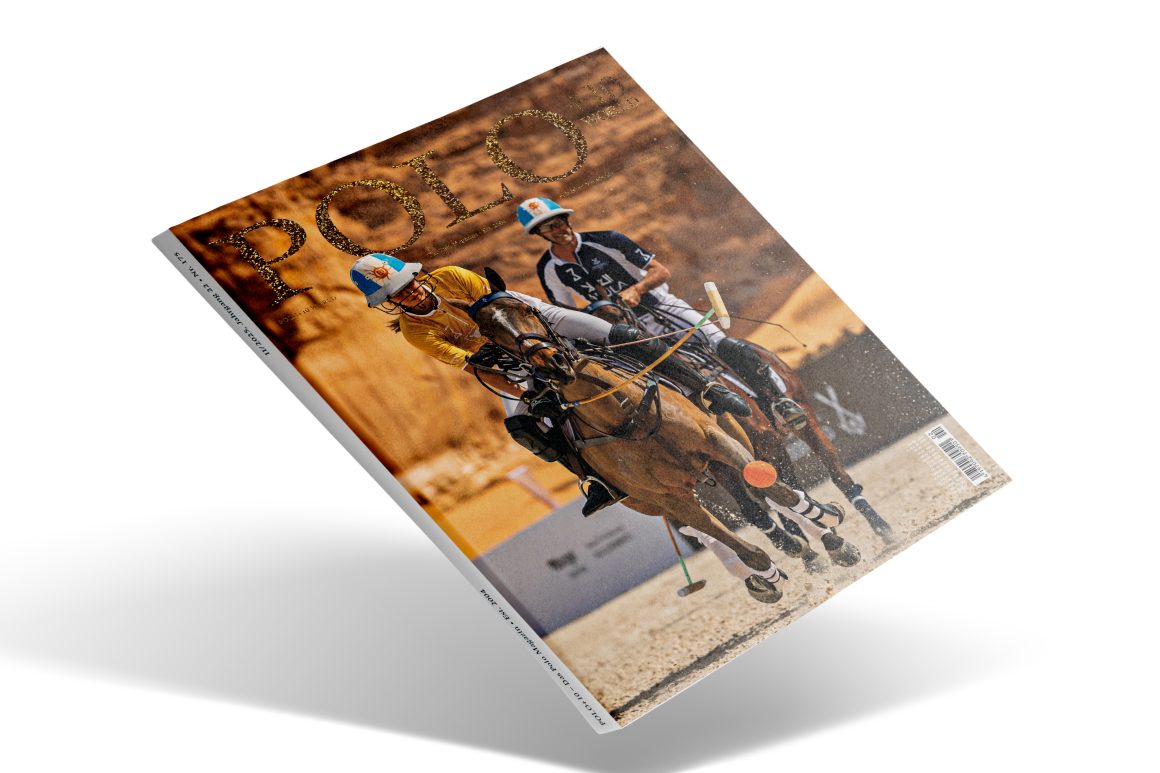

• Net profit for the year increases by 57% to €170.1 million

• Return on equity reaches 82.7%

• Investment bank revenue rises up by 35% to €471.6 million

• 113 capital market transactions provide companies with €31.6 billion in capital

Hamburg. In 2021, Berenberg achieved the best result in its 432-year his-tory. The net profit of €170.1 million achieved operationally in 2021 ex-ceeded the already very good previous year’s result of €108.2 million by 57%. This resulted in a return on equity of 82.7% (PY 52.0%).

“Across all business areas, we were hugely successful in growing our business in 2021,” says Hendrik Riehmer, Managing Partner. “With our business model – aligned to providing independent advice – as well as impressive performance, we were able to win many new clients and assets in our core markets of Germany, the UK, Europe and the US.”

“Our Investment Bank has achieved a record year: Capital market transactions up 114%, Equity Trading up 50%, expansion of covered companies and market share gains in research”, David Mortlock, Managing Partner, explains the main drivers for this outstanding result. “Strong new business in Wealth Management and high inflows of funds from our high-performing investment funds in Asset Management and the credit fund range in Corporate Banking also led to the highest net commission income ever achieved,” Riehmer states.

Net commission income rose from €415.6 to €572.5 million (+37.8 %) in the reporting year. Revenues in the Investment Bank alone rose from €350.5 to €471.6 million (+34.6 %). Net interest income, a metric less relevant for the result and our business model, fell as expected from €55.8 million to €37.5 mil-lion (-32.8 %) due to perpetually ultra-low interest rate levels. Trading profit increased from €6.8 to 8.7 million (+29.3 %), while other operating result, which in the previous year was shaped substantially by major non-operating effects, normalised from €17.7 million to €9.7 million (-45.2 %).

Berenberg has invested further in strengthening its high-performance business model. Thus, the number of employees in the group increased from 1,573 to 1,703 (+8.3%). Both personnel expenses (from €226.5 to €274.4 million; +21.1%) and material costs (from €115.5 to €129.4 million; +12%) increased significantly. “In 2021, we were once again able to attract excellent employees to continue our growth. Personnel expenses increased due to strong staff growth, as well as variable salary components attributable to the outstanding financial year. We were also able to use our earnings situation to make targeted investments in our IT and drive forward the digitalisation of our business processes. In doing so, we guarantee our customers a first-class service and also increase the efficiency of our processes in the medium term,” explains Christian Kühn, Managing Partner.

The return on equity rose significantly from 52.0% to 82.7%. The cost-income ratio improved from 70.9% to an excellent 65.8%. The ratio of current net interest income to net commission income shifted further in the direction of net commission income and, at 6:94 (PY: 12:88) underscores the out-standing importance of commission business. The Tier 1 capital ratio stood at 13.3 % (PY: 13.5 %), thereby being comfortably above the regulatory requirements. 2021, we not only strengthened our Tier 1 capital through a capital in-crease, but also further built up the core capital on balance by issuing AT1 funds. The bank’s total capital was significantly increased from €295.5 million to €341.7 million. As a result, the T1- ratio is a strong 15.4 % (PY: 13.5%). The total capital ratio rose from 15.7% to 17.4%.

Net new assets in Wealth and Asset Management amounted to €4.2 billion, total assets under management rose from €41.3 billion to €44.8 billion (+ 8.5%). It should be considered here that assets under management of €5.6 billion were lost in the reporting year due to the discontinuation of Overlay Management and the transfer of business to a cooperation partner.

Total assets increased significantly from €4.7 billion to €6.4 billion (+37.0%), in particular, due to a strong increase in liabilities to customers due on demand, which were predominantly invested as credit balances at central banks on a daily basis. The increase resulted from an expansion of business in Wealth and Asset Management, as well as in Equity Capital Markets. Here, the companies advised on IPOs and issues temporarily invest part of the cash inflows generated with Berenberg.

The bank has taken advantage of what was once more a strong earnings situation, and has already formed all of the provisions to be made until 2022 in accordance with the new regulations for general loan loss provisions (BFA7). “We did not need to record any specific valuation allowances in our credit business in the reporting year. When considered alongside the high amount added to the general valuation allowances at an early stage, this reflects our prudent and conservative governance approach,” says Kühn.

Wealth Management

Berenberg Wealth Management focuses on providing a range of investment services for very wealthy private investors, family entrepreneurs and decision-makers, as well as foundations and other non-profit organisations. The core service is asset management, where clients can choose from a variety of strategies that consider different risk-return profiles. “In 2021, almost all of our asset management strategies outperformed their benchmarks, as did almost all in-vestment funds,” Riehmer says. Therefore, an increasing number of clients are turning to portfolio management. Berenberg, however, also continues to offer tailored investment advice from a regulatory perspective, in which the client makes the investment decisions in dialogue with the advisor.

“The need for personal advice on complex assets remains steadfast. This re-quires competent and experienced advisers who understand the circumstances of their customers. Digital solutions, such as the Berenberg Wealth Management Portal, round off the range of services on offer.”

Asset Management

Berenberg Asset Management is active in two key areas: It stands for fundamental expertise in equities, in a way rarely found in Germany (“Equity Funds”) and for globally active investment strategies and funds with a European focus (“Multi-Asset”). Of the 21 Berenberg funds with the necessary track record of three years, 18 currently have a 4- or 5-star rating from Morningstar due to their strong performance. “The success and performance of our investment funds are reflected, on the one hand, in the strong increase in assets under management, but also in the numerous awards we received in 2021,” says Riehmer. Another item worthy of mention here is the Scope Award as “Best Asset Manager” in the category Specialised Providers and the Refinitiv-Lipper Award as “Best Equity Fund Manager Europe” in the category Small Asset Managers.

“The cornerstones of our strategy are fundamental equity analysis, a long-term investment horizon and focused portfolios,” Riehmer explains. In equities, the bank now has first-class products in Germany, Europe, Global, Small Caps and ESG. In multi-asset products, investors focused on offensive and sustainable investment strategies.

Investment Bank

“The Investment Bank continued to grow its business scale significantly and gain market share in 2021,” Mortlock said. The number of companies covered by Equity Research was increased from 1,100 to 1,250. To this end, the number of analysts working in London, New York and Frankfurt was increased from 116 to 129. The 76-strong sales team serves 950 institutional clients in all major financial centres in Europe and the USA. Despite the pandemic-related restrictions, the Bank hosted 30 virtual investor conferences and organised more than 30,000 meetings between investors and the management teams of the companies we analysed.

In Equity Trading, the previous record turnover of €100 billion was exceeded by 50% and now stands at €150 billion. “We were able to further expand electronic trading and are well on the way to becoming the platform with the third largest market share in Europe. A 50 % increase in turnover from corporate acquisitions in the European risk arbitrage business secured us additional market share and fifth place in the overall European risk arbitrage business,” Mortlock explains.

We had another record year in Equity Capital Markets. Here, the bank was once again able to defend its market leadership in the German-speaking region with 21 lead-managed transactions. Activities included the largest German IPO (Van-tage Towers with €2.3 billion) and the capital increase of Siemens Healthineers (€2.3 billion).

In the UK, 32 transactions, including the IPO and three secondary placements (total value £ 586m) of Darktrace were completed. Berenberg now serves 52 companies (PY: 40) in Corporate Broking. We were also able to significantly expand our market share in Benelux. Therefore, the Bank opened a branch office in Brussels in the reporting year. But we are also increasingly being mandated in capital market transactions in both the Nordic countries and Southern Europe.

US business has also developed rapidly. The number of transactions increased from 12 to 18. The IPO of the German electric car company Sono Motors (USD 173 million) on NASDAQ, which we conducted as sole bookrunner, recorded the second-best first-day performance of a US IPO in 2021.

In total, Berenberg completed 113 transactions (PY: 67), with the volume more than doubling from €14.8 to €31.6 billion.

Corporate Banking

Corporate Banking serves capital market-related and medium-sized companies and, in addition to traditional Corporate Banking, includes the sector topics of Shipping and Real Estate, Infrastructure & Energy, as well as the specialised field of Structured Finance. A special focus is on the issuance of credit funds (Private Debt). With 20 credit funds, Berenberg now offers entities such as institutional investors and large single-family offices the opportunity to invest in loans and generate decent returns in a low-interest environment. The focus here is on structured finance, ship loans and projects from the energy and infrastructure sectors. “In the Private Debt asset class, we are one of the fastest growing asset managers in Europe and were recently named “Best Asset Manager Private Debt” by the Scope rating agency,” explains Riehmer. In the discipline of Structured Finance, more than 30 transactions were lead-managed in 2021 and €1.5 billion were invested. Due to strong demand in the energy and infrastructure sectors, two credit funds are to be added to the fund range this year. In the shipping sector, 160 ships with a volume of more than €1 billion are currently financed – due to the prevailing conservative alignment of investment activities and many years of know-how without any performance problems. We place particular emphasis on our conservative and largely constant loan portfolio.